Car insurance expenses can significantly reduce a fixed retirement income, particularly for older drivers who want to remain safe and independent while driving. This is why many seniors wonder: Does installing a dash cam really reduce insurance costs?

Most insurance companies don’t offer a direct discount just for owning a dash cam, but these small, easy-to-use devices can still save you a significant amount of money in other ways.

Dash cam footage from an accident can quickly verify what happened, protect you from false claims, and help you avoid paying a deductible for a non-fault crash. This leads to faster claim resolution, reduced stress, and improved financial security.

This guide explains how dash cams affect insurance, when they can lower your personal expenses, and whether they’re a good choice for older drivers seeking peace of mind and long-term savings.

Do Dash Cams Actually Lower Insurance Premiums?

Insurance companies typically determine your premium based on factors such as your driving history, age, location, vehicle type, and annual mileage, rather than whether you have a windshield-mounted camera.

Dash cams make a financial difference after an accident, when there is no clear evidence, which can make the crash turn into one driver’s word against the other.

You could be found at fault even if you did nothing wrong in that situation, and that’s when insurance costs often rise for the next three to five years.

Drivers held responsible for an accident usually face increased premiums afterward, making solid proof essential.

A dash cam can also speed up the claims process. Instead of long phone calls, disputes, and stress, you have clear footage that the insurance company can review quickly.

Being found at fault in an accident is one of the main reasons insurance premiums increase. Clear dash cam footage can help you protect your current low rate and avoid paying higher premiums in the years ahead.

When can a Dash Cam Save You Money?

A dash cam is useful whenever there’s a dispute about what occurred on the road. Without video evidence, insurance investigations can be delayed, and you might lose the claim if the details are ambiguous.

Clear footage enables the insurer to observe the sequence of events, identify responsibility more efficiently, and expedite claim resolution, helping you reduce costs.

A major savings opportunity occurs when you avoid paying the deductible for an accident you didn’t cause. If the video evidence shows another driver running a red light, reversing into your car, or hitting you in a parking lot, you’re much more likely to get reimbursed without tapping into your own insurance coverage.

Dash cams serve as strong protection against staged accidents and false injury claims. These setups unfairly shift blame to cautious drivers and can lead to higher premiums for years if no evidence is available.

Clear footage significantly reduces the likelihood of fraudulent claims succeeding and helps insurers settle cases based on factual evidence.

The National Insurance Crime Bureau notes that staged auto accidents cost insurers and policyholders billions annually, and those costs are ultimately passed on to drivers through higher premiums.

A dash cam can save you money when:

- Another driver falsely claims you caused the crash.

- You are involved in a hit-and-run

- Your car is damaged while parked.

- A pedestrian or cyclist suddenly steps into the road.

These footages could determine whether you pay out of pocket or keep your current insurance rate.

For seniors, financial protection is often more important than a small discount because it helps maintain predictable monthly expenses and safeguards a carefully managed retirement budget.

How Dash Cam Footage Helps With Insurance Claims?

The most important question for an insurance company after an accident is: who was at fault?

The insurance can then determine how quickly the claim is paid, whether you must cover the deductible, and whether your premium will increase.

Without video, the process often relies on statements from both drivers, possible witnesses, and the police report. The claim can take weeks when the stories don’t align.

The footage can show:

- The driver who had the right-of-way.

- Whether you were speeding or driving normally.

- The color of the traffic light.

- The distance between vehicles.

- What happened in the seconds before impact?

This visual proof makes it much easier for the claims adjuster to make a fast and fair decision.

Faster Claims, Less Stress.

In many cases:

- The insurance decides liability faster.

- Repairs begin sooner.

- You avoid paying out of pocket while waiting.

Protection When There Are No Witnesses.

Dash cam footages beecome valuable in situations such as:

- Hit-and-runs.

- Parking-lot damage.

- Rear-end collisions.

- Drivers who suddenly brake in front of you.

The camera becomes your independent witness when you are alone with no one to support your version of events.

Why This Matters Financially?

A faster and more accurate claim helps you:

- Avoid being wrongly found at fault.

- Keep your no-claims history.

- Prevent long-term premium increases.

That protection is often worth far more than the dash cam’s cost for drivers on fixed incomes.

A guide on how dash cams can protect seniors after an accident highlights how video evidence can support your claim and reduce stress after a crash.

Are Dash Cams Worth It for Seniors on a Budget?

Every monthly expense matters to many older drivers. A good, easy-to-use dash cam typically costs between $100 and $200 as a one-time purchase, with no monthly fees.

The numbers quickly favor the camera when compared with the potential cost of an insurance deductible, vehicle repairs, or a premium increase that lasts for several years.

Even a minor accident can lead to:

- A deductible of $500 or more.

- Higher insurance payments for the next 3 to 5 years.

- Out-of-pocket costs while a claim is being investigated.

driving.

Financial Protection Without Ongoing Costs.

- One-time purchase with no subscription fees.

- Automatic recording without daily setup required.

- Continuous protection every time you drive.

- Helps keep your monthly budget predictable.

Peace of Mind Has Real Value.

- Confidence knowing your driving is documented.

- Less worry about false claims or disputes.

- More comfort in heavy traffic and parking lots.

- Reassurance for both you and your family.

A Small Investment That Can Prevent a Large Loss.

- Costs far less than a single deductible.

- Helps prevent long-term premium increases.

- Protects your safe driving record.

- Delivers long-term value for a fixed income.

Our comparison of the eight best Rexing dash cam options highlights the features that offer the best value for older drivers.

Senior-Friendly Features for Insurance Protection.

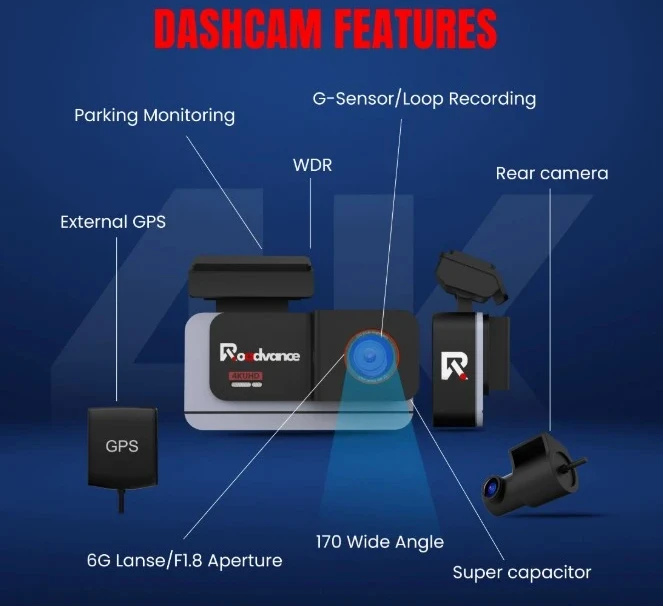

The best model records reliably, automatically saves important footage, and is easy to use when you need it for an insurance claim.

Automatic Recording.

- Starts recording when you turn on the car.

- No buttons to press or settings to remember.

- Ensures every trip is documented.

G-Sensor (Emergency Lock).

- Automatically saves the video when it detects an impact.

- Prevents important footage from being overwritten.

- Gives you a protected file ready to send to the insurer.

Loop Recording.

- Continues recording without managing storage.

- Deletes old, unimportant clips automatically.

- Keeps the camera working without your intervention.

Clear Day and Night Video.

- Makes license plates and road signs readable.

- Provides usable evidence in low-light conditions.

- Helps insurers clearly see what happened.

Wide Viewing Angle.

- Captures multiple lanes of traffic.

- Records vehicles approaching from the side.

- Reduces blind spots in the footage.

Simple File Transfer for Claims.

- Easy to send a video to your insurance company.

- Wi-Fi or app access without removing the memory card.

- Saves time during the claims process.

You won’t have to figure out complex settings or search for the right video for this dash cam.

Best Easy-to-Use Dash Cams for Seniors.

The best dash cam automatically records clear footage and saves important footage with no effort on your part.

Look for models that offer:

- Plug-and-play installation.

- Large, easy-to-read screens or app control.

- Automatic engine start and stop.

- Clear video in both daytime and nighttime driving.

- A reliable G-sensor that locks accident footage.

Our guide to the five best easy-to-use dash cams for older drivers can help you review models with simple controls for reliable accident recording.

Pros and Cons of Using a Dash Cam for Insurance Protection.

Pros.

- Helps prove you were not at fault in an accident.

- Protects your safe driver record and current premium.

- May prevent you from paying an unfair deductible.

- Speeds up the claims process with clear video evidence.

- Provides protection in hit-and-run and parking-lot damage.

- One-time cost with no monthly fees.

- Adds peace of mind every time you drive.

Cons.

- Does not usually give a direct insurance discount

- Good video quality requires a modest upfront investment.

- Footage must be saved or shared after an incident.

- Needs basic installation and a memory card.

- Privacy laws in some states may limit audio recording.

Final Thought: Is a Dash Cam Worth It for Seniors?

For most older drivers, a dash cam is not about getting a small insurance discount; it’s about protecting the low premium you already have.

A simple, reliable dash cam can provide clear proof of what really happened, while a single accident in which you are wrongly found at fault can increase your insurance costs for years.

It becomes a quiet financial safety net in the background with a one-time purchase and automatic recording every time you drive. You gain faster claims, less stress, and stronger protection for your retirement budget.