Email helps you stay in touch with family, receive updates from your doctor, shop online, and manage your finances all from the comfort of home. Still, it is also one of the most common ways scammers try to trick people, especially older adults.

Scammers send millions of scam emails every day that often look genuine, pretending to be from banks, online stores, government agencies, or even people you may know. At the same time, such messages are intended to fool you into giving away personal or financial information.

The good news is you can still avoid them to stay safe if you know what to look for, and that’s precisely why we feel compelled to share this guide.

Whether you are new to email or you have been using it for years, this easy-to-follow guide will walk you through the warning signs, what to do if something feels off, and how to protect yourself and your loved ones online.

What Is a Scam Email?

Scam emails are messages sent by a scammer to trick you into doing something that benefits them, such as stealing your money, personal information, or account access. These emails often look like they come from someone you trust, while they are from a criminal trying to fool you.

For example, scam emails may try to:

- Get your bank or credit card details.

- Steal your Social Security number.

- Trick you into clicking dangerous links.

- Install harmful software on your computer or phone.

- Convince you to send money or gift cards.

The senders of these emails pretend to be a bank or credit card company, an online store like Amazon, a government agency like the IRS, or a friend or family member in trouble.

Why Do Scammers Target Seniors?

Malicious individuals often target older adults who are less familiar with how emails work and tend to trust people, believing they are of good faith.

They also think seniors have saved enough money during their careers and may do everything possible to avoid stealing their hard-earned money, or may even hesitate to ask for help.

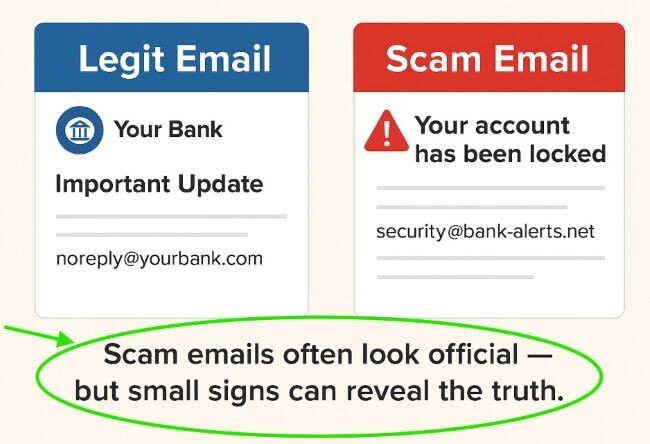

Below is a real-life example of a fraudulent message you may receive:

Subject: “Your account has been locked! Please click here to verify your identity.”

From: security@bank-alerts.net.

This scam email appears to come from a legitimate bank, intended to panic you into clicking a dangerous link, but it’s fraudulent.

How to Spot a Scam Email Immediately?

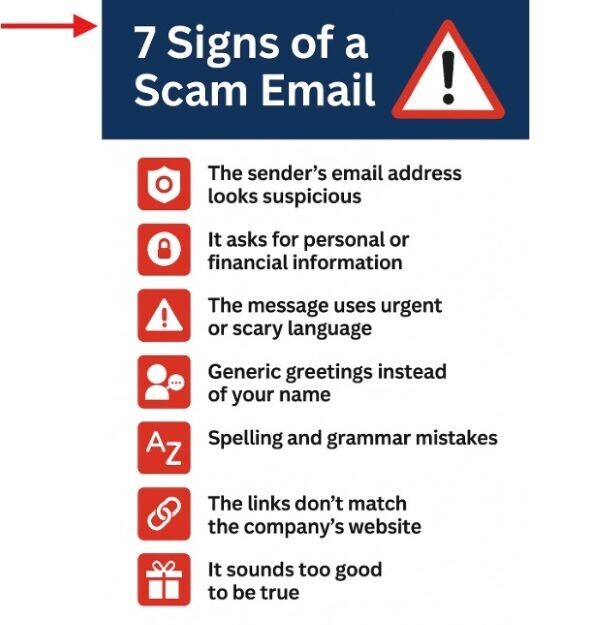

Scam emails often share a few warning signs you can spot to delete them quickly, before they cause any harm.

Below are the most common red flags to watch for:

1. The Sender’s Email Address Looks Suspicious – Scammers often use addresses that look similar to real ones but include minor errors, such as support@amzon-alerts.net (fake) instead of: support@amazon.com (real).

Tip: Hover your mouse over the sender’s name to see the full email address.

2. It asks for Personal or Financial Information – Legitimate companies never ask for your password, PIN, or full Social Security number by email.

Always delete immediately an email that says:

- “Verify your identity now.”

- “Confirm your credit card number.”

3. Urgent Messages or Scary Language – Scammers create a sense of panic to entice you to act before thinking. You can spot them with phrases like:

- “Your account will be closed in 24 hours!”

- “You have been hacked — click now to fix it!”

Tip: Always be cautious of such messages, as a trustworthy company wouldn’t threaten or rush you.

4. Generic Greetings Instead of Your Name – Legitimate emails usually greet you by your name, such as “Hi Margaret, here’s your monthly update…”, while scams typically say “Dear Customer” or “Dear User”.

5 . Spelling and Grammar Mistakes – Many scam emails come from overseas with odd wording or grammar issues.

Example: “Your acount are been suspended”. “Kindly to click for solve.”

6 . The Links Don’t Match the Company’s Website – Hover over links before clicking to see if the link matches the official site or if it’s likely a scam.

Example: Click here to update the account: www.bank-alerts.com?verify.

==> A genuine bank account site would be: www.yourbank.com.

7. It Sounds Too Good to Be True – Scammers also send strange messages such as “You’ve won $1,000 gift card! Click to claim your prize!”. While you haven’t entered any contests.

Related Content: Online Safety Tips Every Senior Should Know

What to Do If You Think an Email Is a Scam?

Don’t panic, and don’t click on anything if you receive a suspicious email aimed at enticing you to act quickly. Stay calm and cautious to protect yourself.

Don’t Click or Reply.

- Avoid clicking on links, downloading attachments, or replying to the sender, even if the message looks official.

- Fraudsters send scam emails to trick you into confirming that your email address is active or to install harmful software without you realizing it.

For example, clicking a link might lead to a fake website that requests your bank login information, or downloading an attachment might install spyware on your computer or phone.

Look Closer Before You Delete It.

Take a moment to hover over the sender’s name to see the real email address before deleting the email.

- Hover over any links to check where they go (don’t click!).

- Look for red flags: spelling errors, urgent language, and a strange sender.

Never Share Personal Information.

Legitimate companies will never ask for your password, credit card number, Social Security number, or other details over email.

- Move it to your Spam or Junk folder.

- Or delete it completely.

Tip: Mark the email as spam in your Gmail, Outlook, or another major service to help the system learn and protect other users.

Act Quickly If You Clicked Something by Accident.

Change your passwords immediately if you click a suspicious link, download a file, or enter any private info, especially for your email and any accounts linked to your finances or identity.

Then use unique and hard-to-guess passwords when creating new ones. Include at least eight characters, with a mix of uppercase and lowercase letters, numbers, and symbols.

Talk to Someone You Trust.

- Don’t stress about figuring this out on your own if you have difficulties.

- Ask a friend, caregiver, or family member for a second opinion, as two sets of eyes are always better than one to stay safe online.

Want to do more online safely and confidently? Learn how to create a website in your your hobby niche or life experience and leverage affiliate marketing to earn extra income as your buness grows.

How and Where to Report Scam Emails?

Reporting a scam email allows companies, banks, and even law enforcement to stop these attacks more quickly, thereby protecting you and others from falling into the same traps.

Reporting Scam Emails.

- Helps shut down scam websites or email addresses.

- Alert email providers, such as Gmail or Outlook, can block similar messages.

- Supports organizations tracking cybercrime trends.

- Protects friends or family who might receive the same scam.

Where to Report Scam Emails?

The most trusted and easy-to-use places to send scam emails include:

Report to the FTC (Federal Trade Commission).

The FTC tracks and takes action on primary scam operations.

- Visit: reportfraud.ftc.gov.

- Click “Report Now.”

- Choose “Email Scam” and follow the steps.

Forward to the Anti-Phishing Working Group.

The Anti-Phishing Working Group organization shares scam reports with law enforcement and companies.

- Forward the scam email to: apwg.org/reportphishing.

- Please do not change the subject or content; forward it as is.

3. Report to the Imitated Real Company.

You can also report a scam that pretends to be from a reputable company, such as Amazon, PayPal, your bank, or Netflix.

Visit the company’s website and search for “report phishing” to find their official address.

4 . Mark as Phishing in Your Email Service.

Most email providers have a “Report phishing” or “Mark as spam” option to tell the system to block similar future incoming messages.

- In Gmail: Click the three dots next to the email → Select “Report phishing”.

- In Outlook: Right-click the email → Choose “Mark as phishing”.

- In Yahoo: Click the “…” icon → Select “Report a phishing scam”.

Related Content: How to safely download and install apps on your phone or tablet?

5. Call Your Bank or Credit Card Company (If You Gave Info).

- Call your bank’s fraud line right away if you shared financial information or clicked a link that asked for it to freeze or monitor your account.

- Your financial institution will typically issue a new card or assist you in taking any additional steps necessary.

Smart Habits to Avoid Future Email Scams.

Spotting scam emails is great, but building a few simple habits helps you avoid them for good. It’s like locking your front door or checking who’s at the door before granting access.

Be Cautious with Unknown Emails.

Be skeptical of emails from someone you don’t recognize or a company you have never dealt with. You don’t have to open every message, so trust your instincts to post something that feels off.

Use Strong, Unique Passwords.

Don’t reuse the same password for multiple accounts. A strong password should include:

- At least eight characters.

- A mix of letters, numbers, and symbols.

- No personal information (like your birthday or pet’s name).

Write your passwords down in a secure notebook or use a trusted password manager app, and keep your software up to date to patch security holes that scammers typically try to exploit.

- Update your device’s operating system (E.g., Windows, macOS, Android).

- Update your email app or browser regularly.

- Enable automatic updates that occur in the background to enhance your online protection and safety.

Don’t Share Personal Info by Email.

Never share your passwords, banking information, Social Security numbers, or personal documents or photos, even if they appear to be from official emails.

- Legitimate companies will never request sensitive information via email.

- Ask for help if you are unsure how to distinguish between good and malicious emails to prevent potential incidents.

Related Content: Best Hearing-Friendly Headsets for Seniors.

Frequently Asked Questions About Scam Emails.

What should I do if I clicked a link in a scam email?

Stay calm if you accidentally clicked a link in a suspicious email, and act quickly to close a webpage that opens without entering any information. Use an antivirus software to run a security scan on your computer or phone and check for any threats.

Then, change your password immediately and contact your bank or credit card company if you have shared any personal or financial information, such as your login credentials, password, or credit card number, to report the situation.

You may also enable two-factor authentication on your accounts for added protection and consider asking a trusted friend or family member for assistance if you encounter any issues.

Can I get in trouble just by opening a scam email?

Opening a scam email won’t cause any damage in most cases. Modern email programs, such as Gmail and Outlook, often block harmful images or code unless you specifically allow them to load.

However, problems usually begin if you click on a link or open an attachment from suspicious emails. Delete these emails immediately and mark them as spam or phishing to help your email service learn and protect you from similar messages in the future.

Are all scam emails obvious or poorly written?

Many scam emails used to be filled with spelling mistakes and unusual grammar, but scammers have become much more intelligent and sophisticated. Their emails today appear very convincing, complete with imitated authentic company logos, colors, and professional language.

Always look closely to detect errors such as a strange sender address, a generic greeting like “Dear Customer,” or something asking you to click on a link that leads to a fake website.

How can I block scam emails from appearing in my inbox?

Teaching your email program to recognize scam emails empowers it to drastically reduce the number of scam emails.

- Mark suspicious messages as “Spam” or “Phishing” to tell your email service to block similar messages in the future.

- Avoid sharing your email address in public places, such as social media comment sections or online forums.

- Adjust your email settings or filters (or ask for help) if you continue to receive too many scam messages.

What is the difference between spam and scam emails?

Spam emails are mostly unwanted or annoying advertisements, such as promotions, sales, or newsletters you didn’t sign up for, but they are not dangerous.

On the other hand, scam emails aim to trick you by attempting to steal your money, passwords, or personal details, often using urgent or alarming messages to quickly capture your attention, making them much more dangerous than regular spam.

Can I get my money back if I fall for a scam?

Your bank can reverse the charge or stop the payment if you made a payment with a credit card or bank account, but you must act quickly to report the incident.

Report the scam immediately to your bank, the company involved, and the Federal Trade Commission (FTC). Even if you can’t get your money back, reporting the scam may prevent others from falling victim.

Should I change my email address if I get a lot of strange emails?

Building safer email habits is often a better approach than changing your email address, which might seem like a quick fix, but is usually unnecessary.

Mark suspicious messages as spam, avoid clicking on unfamiliar links, and don’t sign up for websites that seem untrustworthy.

You can also create a second email address that you use only for shopping or newsletter sign-ups, and keep your primary email for personal or essential use.

Final Thoughts.

This guide taught you how scam emails work, how to recognize their warning signs, and what to do if one shows up in your inbox.

From checking the sender’s address to reporting scams to trusted agencies like the FTC, you now have the tools to stay one step ahead of email fraud.

Staying safe online doesn’t demand technical skills. It just requires a calm, cautious mindset and a willingness to ask questions when something feels off, whether you’re browsing for fun, shopping online, or learning something new. Your inbox should be a place of connection, not confusion.