Criminals typically use stolen information to open bank accounts, make purchases in the victim’s name, or even take out loans in someone else’s name, which is something to worry about to avoid being a victim.

Such online threats can have severe consequences, including significant loss and stress, unless you know the warning signs to act quickly and protect yourself from such risks.

Therefore, we feel compelled to share a guide that walks you through the signs of identity theft, the steps to take immediately if you suspect the threats, and simple habits to prevent being scammed in the future.

Signs That You May Be a Victim of Identity Theft.

Identity theft doesn’t always happen immediately, so you might not realize it until you see unusual activity in your accounts or get unexpected bills. Unless you recognize the warning signs, you may not act in time before it worsens.

For example, you can watch for the following common signs:

- Unfamiliar charges on your bank or credit card statements, even if they are small amounts.

- Bills or debt collection calls for accounts you didn’t open or never signed up for.

- Emails or texts saying your password has been changed without your knowledge.

- A sudden drop in your credit score can occur when identity thieves apply for loans or credit cards in your name to damage your credit history.

- Stolen mails that include bank statements, tax forms, or new credit cards.

The Federal Trade Commission (FTC) reports that the most common warning signs of identity theft include unusual financial activity, debt collection calls, and changes to credit reports.

Tip: Investigate immediately if something doesn’t look right with your finances or accounts.

Steps to Take if You Suspect Identity Theft.

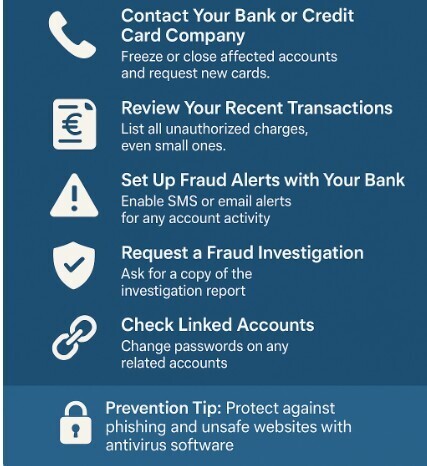

Secure Your Finances Immediately.

Contact Your Bank or Credit Card Company.

- Call the number on the back of your card or on your bank statement.

- Tell them you suspect fraud or identity theft.

- Ask them to freeze or close the account and issue you a new account number and card.

- Request written confirmation of the actions taken.

Review Your Recent Transactions.

- Verify online banking and paper statements carefully.

- List unauthorized charges, including dates and amounts.

- Small charges often indicate a thief wants to check if your account is active.

Related Content: Visible by Verizon Wireless Prepaid Plans for Seniors.

Set Up Fraud Alerts with Your Bank.

- Most banks allow customers to opt for SMS or email notifications for purchases or withdrawals.

- Activate these to detect unusual activity instantly.

- Request a fraud Investigation from the fraud team, who may reverse the reported unauthorized charges.

- Ask for a copy of the fraud report for your records.

- Check linked accounts if you use the exact login email and password for multiple accounts, and change them immediately.

Tip: Keep a record of every phone call, letter, or email you exchange with your bank to prove fraud if it occurs later.

Report the Fraud.

The next crucial step after securing your financial accounts is to create an official record of the crime to help authorities track fraud patterns and provide you with documents that support your claim to recover the lost money.

Contact immediately the following agencies and institutions:

Government Agencies.

- File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov in the United States.

- Report the fraud through the European Consumer Centre Belgium in Europe to get guidance on how to dispute fraudulent charges and protect your consumer rights.

- Check your national consumer protection office or financial regulator for local reporting tools in other countries.

Other Institutions.

- Bring copies of fraudulent statements, letters, or emails to file a police report, which will help you dispute fraudulent debts.

- Contact Equifax, Experian, and TransUnion, which are the three major U.S. credit bureaus, or your national credit bureau or local banking authority in Europe.

- Notify the relevant agency if scammers have stolen your social security number, national ID card, or health insurance card.

- Notify Gmail, Outlook, or another provider to secure or recover your email account if it has been compromised.

Why Reporting Matters?

Creating an official paper trail proves that you were a victim of a crime, and your rights are protected from fraudulent debts assigned to you. You can easily dispute unauthorized charges with banks or credit card companies if you have evidence to support your case.

Reporting also provides law enforcement with valuable data to help authorities detect and dismantle identity theft networks, thereby enhancing protection against other forms of financial damage.

Prevention tip: Keep copies of every document you file, as you may need them to work with banks, credit agencies, and government offices to resolve the issue.

Place Fraud Alerts and Credit Freezes.

Ensure thieves can’t continue using your information to open new accounts after securing your finances and reporting the fraud.

Fraud Alerts.

A fraud alert helps creditors and lenders verify your identity before opening any new credit in your name.

- Contact Equifax, Experian, or TransUnion in the United States to place a fraud alert. The alert remains in effect for one year, and it can be renewed if necessary.

- Contact your bank and the national credit bureau in Europe to request additional identity checks when opening a new account.

Credit Freezes.

A credit freeze, also known as a security freeze, prevents anyone, including you, from opening new credit accounts until the freeze is lifted.

- Contact all three major credit bureaus in the United States to place a freeze.

- Contact your local credit bureau or banking authority to inquire about security freeze options available in Europe.

- Temporarily lift or “thaw” the freeze to apply for new credit online or by phone.

==> See our Simple Guide to Antivirus Software for Seniors.

Monitor Your Identity and Accounts.

Identity theft can continue to cause problems for months or even years after you have reported fraud and secured your credit, making it essential to continue monitoring your accounts and personal information.

- Check your bank, credit card, and utility statements monthly to detect unusual transactions and report them to your bank immediately.

- Review your credit reports according to the procedures in the United States, Europe, or your country of residence.

- Monitor your credit report to identify suspicious activity and report it promptly.

- Watch for unusual activity beyond banking to see if fraudsters file false tax returns in your name, use your health insurance information for medical fraud, or apply for government benefits with your personal details.

Prevent Future Identity Theft.

Use the following tips for long-term protection:

- Strengthen your passwords by combining letters, numbers, and symbols, and use a password manager to store your logins securely so won’t have to remember them all.

- Ignore messages that ask for personal details or urge you to act immediately and contact the company directly.

- Shred personal documents, such as old bank statements, utility bills, and any paperwork with your personal.

- Enable automatic updates on your computer, smartphone, or tablet to install the latest security protection.

Frequently Asked Questions About Identity Theft.

What is identity theft?

Identity theft happens when someone uses your personal information, such as your name, Social Security number, national ID, or bank details, for unusual actvities, without your permission. Criminals can, for example, open accounts, make purchases, or even commit fraud in your name.

How do thieves steal personal information?

Thieves use several methods, including phishing scam emails, data breaches at companies that store your details, intercepting bank statements or tax forms, malware or downloads from unsafe websites, and even dumpster diving for discarded bills or personal papers.

What should I do first if I suspect I’ve been a victim of identity theft?

Secure your finances by calling your bank or credit card company, freezing or closing the account, and requesting new cards to limit the damage. Then report the fraud to the authorities.

Will reporting identity theft really help me?

Reporting creates an official record of the crime, which helps you dispute fraudulent charges and protect your credit. The FTC reports that victims who report identity theft early are better protected against long-term financial damage.

What is the difference between a fraud alert and a credit freeze?

A fraud alert tells lenders to verify your identity before issuing new credit; it usually lasts one year and is free. A credit freeze, on the other hand, completely locks your credit file, preventing anyone from opening new accounts in your name until you lift it. It offers stronger protection, but requires more effort when applying for new credit.

Can identity theft affect my health or government benefits?

Identity thieves sometimes use stolen information to get medical treatment, prescription drugs, or government benefits, which can create false records in your name. Always review letters, bills, or official notices carefully and report anything unusual.

How can I protect myself from identity theft in the future?

Simple preventive steps include using strong, unique passwords or a password manager, shredding documents before discarding them, and regularly updating your computer, tablet, or phone.

You should also avoid emails or calls asking for personal information, and use antivirus software with identity protection features.

How much does identity theft recovery cost?

Many banks reimburse fraudulent charges provided you report them promptly. Act quickly to minimize financial and emotional expenses, rather than spending dozens of hours resolving issues, contacting agencies, and repairing your credit.

Is identity theft more common among seniors?

Criminals often target seniors because they assume they are unfamiliar with digital scams. It is essential to stay informed and take preventive steps. Older adults are more likely to experience long-term effects if they fail to report identity theft.

Should I get professional identity protection services?

Seniors can utilize antivirus software with identity monitoring and set up free credit alerts to safeguard their information. However, paid services can provide extra tracking, insurance, or assistance in recovering from identity theft.

Related Content: How to Start Your Own Blog to Share Your Stories Online for Free?

Final Thoughts on Protecting Yourself from Identity Theft.

Identity theft is a serious and growing threat; therefore, it is essential to act quickly to minimize the damage it can cause, as highlighted in this guide.

Start contacting banks and credit card companies to secure your finances, then report the scam to create an official record.

Adding fraud alerts or credit freezes also provides an extra layer of protection, while regularly monitoring accounts and credit reports helps catch new issues early.

Finally, adopt preventive habits, such as using strong passwords, shredding documents, and installing antivirus software, to avoid becoming a victim again.